Reaping rewards … but patiently

On the Enterprise Development Programme participating organisations received a grant to support the development of their trading activity over 12 – 18 months. But beyond that period, we’ve been keen to retain contact, continuing our offer of other wrap-around support such as learning workshops, peer learning and check-ins with their Enterprise Development Manager. This has been particularly helpful for organisations who didn’t start the process with a fully-fledged trading activity and an existing customer base.

Those earlier staged ventures, as expected, do not see overnight success in terms of trading income, or often not even by the end of the programme. However, through our continued dialogue we’ve observed that there is a trend of organisations seeing efforts reaping their rewards 12 – 18 months after the programme, which is 2 – 3 years after they begin a development programme like this.

We’ve seen that the reasons for delayed success can vary and be combined, for example:

- Needing time to increase confidence in the product / service they’re selling and their sales pitch.

- Needing time to learn more about the needs / wants of their customers and some of the common barriers they need to navigate around.

- Having to wait for customer budgeting cycles to present an opportunity to sell or tender.

- And as with any small business it often takes time to slowly build interest and profile before converting that into paying customers.

This scenario creates a quandary for both funders and the charity or social enterprise. Although supported with grant for 12 – 18 months, this lag period waiting for trading success, means there is often a post grant period where a trading activity may be generating some income, but probably isn’t breaking even. Some organisations may be able to ‘wear that’ through other funds but for others, they might have to make the difficult decision to pause enterprise activity until another relevant grant can be secured. This is often the case when there is a need to employ staff specifically for the trading activity, but the uncertainty of future sales makes it difficult to commit to a permanent employee or even a 12-month contract. A pause in operations means momentum can be lost, with customers proving difficult to regain or new competitors coming into the market. And obviously if no other grant is found then that original time, money, and effort of both the organisation and the Funder is effectively lost.

Is social investment the answer? Even though large strides have been made in recent years in terms of the accessibility of social investment – i.e., lower interest rates, inclusion of some development grant, it feels these organisations do not leave the programme with the ability to commit to repayable finance. Although we’re seeing some organisations reach a breakeven point or even a position of consistent surplus, there is a significant ratio of organisations considering the question ‘will we always require some subsidy of funds from other sources to make this viable?’ Instead, there is arguably a place for a follow-up grant based offer focused on further encouraging and incentivising enterprising behaviour.

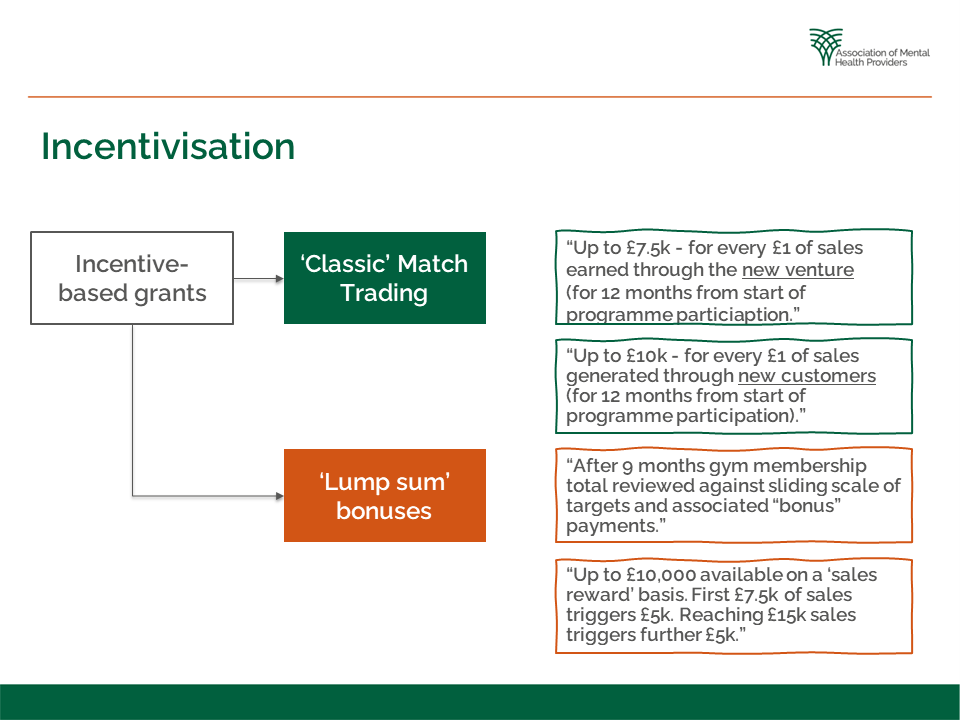

We trialled some grant making of this kind with more established trading ventures in the Enterprise Development Programme with positive results. We found both a combination of encouraging enterprise behaviour through grant conditions and money-based incentives to be effective. We also observed there isn’t one fixed model of incentivisation that works – instead there needs to be an assessment of the organisation’s product / service, revenue model, the types of customers and the commercial objectives. Some examples of how we applied these approaches in different scenarios are shared below.

This type of offer is currently being referred to as ‘enterprise grant making’ in some circles such as the Enterprise Grants Taskforce and it is positive to see it gaining traction. It feels an important piece of the puzzle to help more organisations fully reap the rewards for their trading and enterprise efforts and help more get to the point of a surplus generating, where social investment then may be relevant to scale organisation’s impact even further.